It’s been frequently repeated that San Francisco, Boston, or New York are the best places to locate your business if you want to access seed and early-stage venture funding. While these three cities continue to represent a sizable portion of the deals, companies outside of their Metropolitan Statistical Areas (MSAs) are receiving an increasing share of this capital. Rise of the Rest, a Revolution platform, published a report in 2021 using Pitchbook data, which shows the impact these changes are having. [1] Their 2023 Annual Report is also a fascinating resource. [2] Let’s take a look at a few details from both to kick off Ecosystem month.

Seed and early-stage capital and funding have been departing coastal cities since 2011

This story isn’t new. There has been a downward funding trend for companies within each MSA from 2011-2020, and the 2021 SF data was trending even lower. Bay Area firms are leading the way in bringing capital to smaller ecosystems, with 63% of early-stage dollars going to startups outside the MSA in 2021. In 2020, Bay Area VCs invested $11.7 billion in startups outside of their ecosystem in more than 1,000 rounds. That’s up from $2.5 billion in 383 rounds in 2011.

The observed change is similar in New York, where investors placed $8.5 billion in 756 early-stage rounds in 2020 compared to $1.5 billion in 221 rounds in 2011. [3] The pace of this outflow picked up in 2021, with a total of 5,509 seed and early-stage rounds occurring outside of California, New York, and Massachusetts, with a total deal value of $38.6 billion. Outflow activity slowed slightly in 2022, with 5,373 deals at a $33.1 billion value. [4] The Rise of the Rest team believes this was a temporary rebound towards perceived safety in the Bay Area. I think it’s more likely a statistical swing around the steadily decreasing outside of the Bay Area deal trend line. Their data up to June 30, 2023, showed a shift back toward that trend line. [5]

Growth of smaller ecosystems explains some of the change

The team looked at where Bay Area and New York-based VCs placed early-stage investments over 2011-2021. In their top 30 lists, many cities are the same between the two. There are some differences, which tend to be grouped by geography. For example, Reno, Sacramento, and Tucson (all located west of the Rockies) are only on the Bay Area list, while Charlotte, Buffalo, and Hartford (all within a day’s drive of the East Coast) are on the New York list. [6] The top ten are similar between both lists, suggesting newer seed- and early-stage financing centers have started to emerge. Founders of startups in a city outside of the top ten list may find it more productive to focus on the VCs who are giving their city more attention.

New investors and funding sources are popping up everywhere

Established firms aren’t the only ones behind increased investment outside the traditional coastal MSAs. Investors across the US have increased their activity in seed- and early-stage rounds. In 2020, Pitchbook showed over 3,000 investors active in these rounds, compared to just over 1,000 in 2011. Corporate venture capital, accelerators, incubators, and private equity have all increased their activity in early-stage funding. Furthermore, 1,445 new VC firms were founded outside of the Bay Area, New York, and Boston between 2011 and 2021. These investors are more likely to invest in local or regional startups. They also provide a channel for outside investors to engage in later rounds. [7] This shouldn’t be a surprise. The SEC published a report in late 2023 showing that households qualifying as accredited investors rose from 2.8 to 24.3 million between 1989 and 2023. That’s a jump from 3% to 18.5% of all U.S. households. 16.4 million households have a minimum net worth of $1 million. [8] At some point, many people start thinking about investing in different asset classes to get better returns. The change in definition in 2020 certainly raised the idea for many. Almost everyone likes to support their local startup community, so it makes sense that funds will start in more cities.

Twelve MSAs with exciting stories

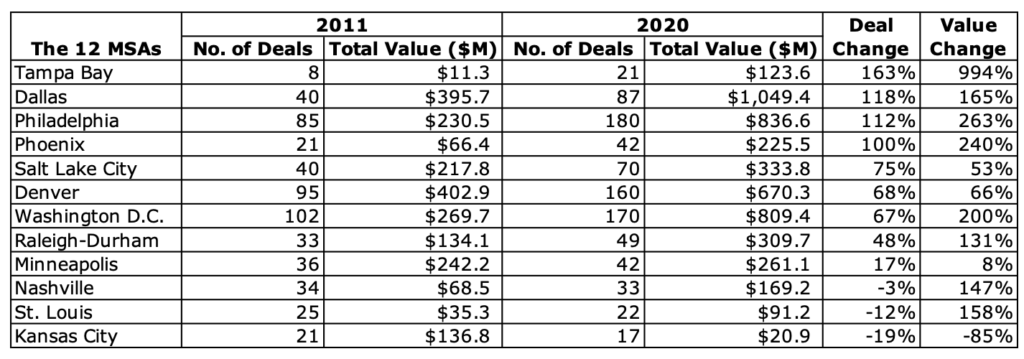

The writers of the Beyond Silicon Valley report expanded their analysis by asking colleagues in twelve of the growth MSAs to elaborate on their success. The common promoting factors include the spread of tech talent, good livability & culture, sector expertise, local corporation support, and university-level entrepreneurship education. [9]. I pulled the deal activity and value data from this report for Table 1. I sorted the data by the change in the deal number. Tampa Bay is the winner in this list, nearly tripling the number of deals over nine years with almost a 1000% total value change. Some cities have relatively flat data across the period yet are areas of continuing interest (Minneapolis is the obvious example). Cities with solid life science and biotech assets from this list include Raleigh-Durham, Washington D.C., Philadelphia, Denver, Minneapolis-St. Paul, St. Louis, and Salt Lake City. I’ll leave it to you to pull the full report if you are interested in the local expert’s analysis.

Table 1. Deal Activity and Value, 2011 and 2020, from selected MSAs [10]

Summary

Revolution and the Rise of the Rest Fund see excellent prospects for finding great founders with the potential for success across the U.S. As the Beyond Silicon Valley report notes, “It’s clearly no longer true that a founder must be in walking distance [of Silicon Valley] to get a check.” [11] I acknowledge that most of this data does not reflect the painful funding desert of 2024. All rounds have shrunk, and bridge, flat, or down rounds are more common. Regardless of your location, you can still raise, but you need to be smart about it. Do your research, only meet with high-value investors, choose those who are willing to stick with you, and be realistic about your budget.

References

[1] Beyond Silicon Valley. Rise of the Rest, a Revolution Fund, September 2021. Accessed April 22, 2024. https://revolution.com/beyond-silicon-valley-report/

[2] Rise of the Rest 2023 Annual Report. Revolution, October 1, 2023. Accessed April 22, 2024. P. 3. https://revolution.com/wp-content/uploads/2023/03/Rise-of-the-Rest-Annual-Report.pdf?y=2023

[3] “Beyond Silicon Valley,” p. 3.

[4] “Rise of the Rest 2023 Annual Report,” p. 3.

[5] Ibid., p. 4.

[6] “Beyond Silicon Valley,” p. 4.

[7] Ibid., p. 5.

[8] U.S. Securities and Exchange Commission, “Review of the “Accredited Investor” Definition under the Dodd-Frank Act”, December 14, 2023. Accessed October 4, 2024. https://www.sec.gov/files/review-definition-accredited-investor-2023.pdf

[9] “Beyond Silicon Valley,” p. 6.

[10] Adapted from “Beyond Silicon Valley,” pp. 7-12.

[11] “Beyond Silicon Valley,” p. 6.

If you enjoyed this article and would like to read more by Katrina, sign up for her newsletter.

Please feel free to contact Katrina at any time!